Ask Caryl: Calculating and Understanding Days in A/R

Q: What is the most accurate method of determining days in accounts receivable (A/R) and what does it mean to my ASC?

Caryl Serbin: Days in A/R refers to the average number of days it takes your ASC to receive reimbursement. The lower the number, the faster you are obtaining payment. Days in A/R should stay below 50 days at minimum; however, 30 to 40 days is preferable.

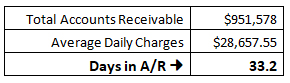

Days in A/R is calculated by taking the total A/R and dividing by the calculated average charges per day over the selected period of time. It is advisable to use calendar rather than business days. Make sure you are comparing like amounts (gross A/R to gross charges or net A/R to net charges).

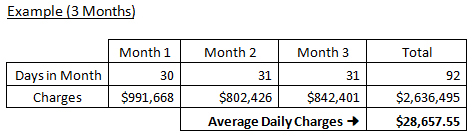

Calculate your average charges per day by:

Adding all of the charges posted for a given period (e.g., 3 months, 6 months, 12 months).

Divide the total charges by the total number of days in the selected period (e.g., 30 days, 90 days, 120 days, etc.).

Next, calculate the days in A/R by dividing the total receivables by the average daily charges.

Begin by calculating your days in A/R using charges for the previous 3-, 6- and 12-month periods. If your ASC has been relatively consistent in monthly volume over the past year, your days in A/R should be similar for all three periods. Unless something changes your volumes, using the previous 3-month period is fine. If there is a large difference in calculated days for those three periods, select the period (either 3, 6, or 12 months) that reflects what you feel will be the average for the next 6 to 12 months. You may want to continue to calculate all three periods in order to get a feel for your facility’s progress. In general, using the previous 12 months gives you a relatively static figure. Using the previous 3 months reflects trends. Choose accordingly.

Due to the variables that go into the makeup of your facility’s A/R, the days in A/R are most valuable when comparing them month to month in your facility. They show the trend in A/R and allow you to spot issues before they get out of hand. They can be used to compare your numbers to facilities within your market that have similar case/payer mix but are not that much of an indicator when comparing to different geographic or demographic locations.

Have an ASC revenue cycle question? Ask Caryl by emailing caryl@serbinmedicalbilling.com or fill out the form at the top of this page.

Never miss a new Ask Caryl by following Serbin Medical Billing's LinkedIn page.